Luckily USA imports very little from China, so most people won’t even notice.

/s104%?

Is this the fucking Onion?!

No, it’s the fucking orange shitstain… 🍊💩

It’s crazy,

But Trump is probably stupider than what the Onion was able to imagine!I read today that one of his secretaries said that China had miscalculated, because China exports roughly four times as much to the U.S. as the U.S. imports to China, and he said that that makes the U.S. a lot stronger than China, that it would give the U.S. a better bargaining position.

That’s like a wealthy family in a small town saying they can outlast the grocery store if the grocery store decides to stop selling food to you.

I mean, good luck with that…

Trump needs to go. How does this fast food and amphetamine monster keep limping along?

When the UK had a Prime Minister stupid enough to tank the economy like this, she was gone before you could eat a lettuce. But she only hurt her own country’s economy, while Trump is doing worldwide damage. The USA needs to step up and get rid of this hopeless leader.

He has to be fueled by hate and spite and maybe drugs. I can say a thousand bad things about him but he sure does have a lot of energy.

Republican support. That’s how.

I meant his heart, his liver, his physical health.

Blood transfusions from young donors.

I wish I was sure that was false.

After this last week I’ll be working until I’m ninety-five.

I’ve been so focused on my stocks that i haven’t even bothered to check my 401k yet. I don’t think I want to know.

Mines -12% YTD. At least I’m not retiring anytime soon.

Aw, c’mon, without Medicare, vaccines, and with RFK, Jr medical protocols, you’ll be dead LONG before that.

Stitching Nike’s.

Those maga hats are going to be expensive

This is Trumps America shooting themselves in the foot with a cruise missile.

Nah, he’s run out of feet to shoot - next shot is aimed for the groin.

I do wish we could fast forward to the part where he Hitlers himself in a bunker.

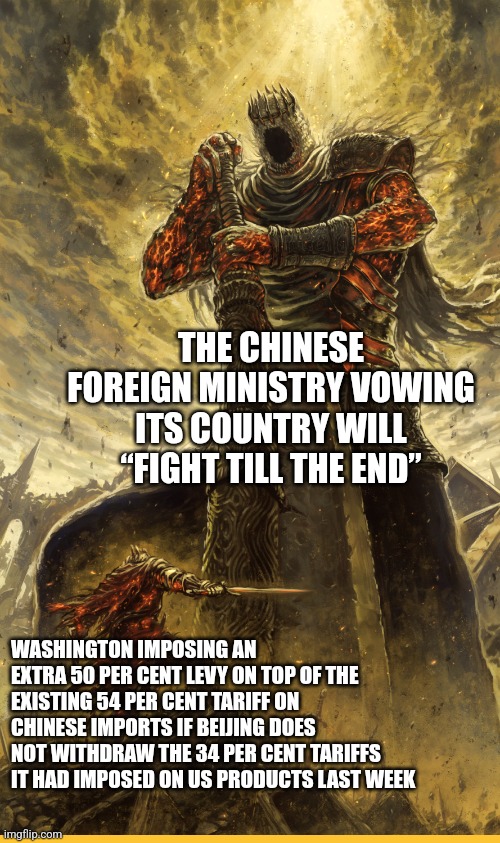

OK. So China is going to retaliate. Because they can. It’s kind of watching a 5 card stud game, and Trump is bluffing. And everyone knows it 🤣

At this point I don’t think the Chinese need to retaliate. They could just say that they will and just wait for the US to put another bullet in their foot.

All Trump understands is “winning” or “losing”. He doesn’t understand negotiations. He doesn’t understand politics. It’s WIN or nothing.

If you ain’t first you’re last

How does this work from an implementation perspective? Is there a field on whatever software that does import taxes that they can tweak? Or is it just backdated from the date of import, based on the invoice?

I believe they get charged when products go through customs. If you want them to get to the US side of the ‘gate’, the importer pays the tariff. One inputs the country of origin, the product category, and the product value, and out pops the required charge.

Probably will have some delays as the software get updated, and I wouldn’t be surprised if a bunch of Chinese goods get re-routed through Vietnam or other countries with lower import tariffs.

I hope >100% wasn’t tested and breaks the software

Probably will have some delays as the software get updated, and I wouldn’t be surprised if a bunch of Chinese goods get re-routed through Vietnam or other countries with lower import tariffs.

trump hit Vietnam with a 46% tariff, so lower than China currently, but still a huge hit.

I was planning on buying a pair of sneakers within the next couple of months. When these tariffs hit, I knew I needed to buy them right now while shelves are still stocked with pre-tariff merchandise. My (popular) brand of shoes are made in Vietnam (46% tariff) and Laos (58%) tariff.

Many popular brands of shoes are made in these two countries so you also may want to do the same.

Do you have an idea of how the value is discerned? For example, what’s to stop someone from putting things on a boat and saying they’re worth a penny?

They have to show the invoice from the supplier.

Yes, where the importer is also the manufacturer (such as cars), the factory can sell at a loss and make up the difference onshore. However, then their tax liability is greater. What they usually do is sell via a tax haven, the importer is based in Barbados, pays their supplier below cost, and the onshore distributor then pays the importer more than they sell for, so they make a “loss” for tax purposes. Tax is only liable on profits.

That does get audited - customs officials do have a look at a lot, and frequently check products against stated claims.

At least this is my experience with my own company’s cross border business - labeling, valuation, documentation of sales and invoices, etc, all matter. We’ve had shipments to the US stopped and held before over what you’d consider minor issues with labeling or newer guys at the ship desk leaving i’s undotted or t’s uncrossed. I’ve had some panicked calls about costing and valuation documentation in big shipments. There were some loopholes to a few rules, but they were small and because these tariffs apply to pretty much everything from any given country, I have a hard time imagining there would be major work arounds for this.

Smaller drop-shippers with more discreet packaging might be able to get away with reducing their numbers - or at least rolling the dice on not getting checked - but for large commercial shipments, absolutely not.

Probably will have some delays as the software get updated, and I wouldn’t be surprised if a bunch of Chinese goods get re-routed through Vietnam or other countries with lower import tariffs.

Most likely they’ll just have is “assembled” (put in a box) in Mexico.

India has 300% tariff on Chinese goods. Everything is still made in China there. US auto workers make $40 an hour, a Chinese autoworker makes $100 a week. Yes there are robots, but they have to be maintained. The difference is the costs of fitters in the US and China is even greater.

There might be a few edge cases where it is cheaper to make in the US ; food processing for example, where the sale price is low and transport is a large proportion, or highly automated things, like making plastic bags or injected moulded stuff like those garden chairs or plastic tanks.

The things that are cheaper to make in the US were already made in the US.

Because of the high cost of labor here, we tend to specialize in things where the unit cost is so high that the labor cost doesn’t matter as much and spending extra for educated and skilled workers becomes a cheaper upgrade. Things like jet engine parts, engines, and machine tools.

Also things where you make a lot of them in an automated fashion, like precision screws and nuts or refined petroleum products. We’re probably not making the plastic bags or chairs, but we would be making the giant tub of plastic beads used for the injection moulding, which is then shipped to Malaysia to be moulded, and then back to the US to be a deck chair.The set of industries that are close enough to the line to make sense to move to the US and can be moved quickly enough for it to matter is vanishingly small.

It’s why most of our exports have been intangible for so long.

I believe it’s paid as part of clearing customs. Since everything is in some capacity inspected (even if that just means checking the weight, container seals, and serial numbers in the freight container), that means there’s some record of what’s coming in and from where. At that point the importer pays customs the various fees and taxes before customs let’s them take the goods out of the port of entry.

The importer would mark it down as part of the taxes that they paid on their purchase, but it would largely only matter so that they can appropriately indicate what portion of the purchase price was taxes that have already been paid so they don’t double pay later.

Ngl, I did NOT have “rooting for the CCP” on my bingo card

They’ll throw in a little Taiwan invasion for shits and giggles and fuck us on semiconductors too. And they’ll succeed, because Trump won’t lift a finger to defend Taiwan

At some point, prolonged US tariffs against Taiwan make rule by China and expulsion of US military assets there politically acceptable. Same argument applies to Japan and the Philippines.

104%?? Seriously? What’s next? 175% tariffs. Trump, you fucking idiot. The rest of the world doesn’t need you.

He’s going have the biggest, the greatest, the best tariffs.

Say bye bye to Nintendo switch 2 pre-order. I wonder what the gamers will do? This is gonna end very bad!

I think it’s mainly Vietnam tariffs that will hit the Switch 2 (Nintendo moved manufacturing their to minimise tariffs in the first place). But they are harsh enough in their own right.

Why not a 1000% felon 47?

What? I had a nap and Trump decided he liked tariffs and all but that he wasn’t tariffing hard enough so now he’s gonna double the price of all Chinese goods. Oh lawd. Guess I’m waiting a few years to build my next PC.

No way. You’ll totally be able to afford to get one tariff free from those new factories that are absolutely bigly being built right now in the great state of America.

Everything should be up and running in a week or so. They just fast tracked all the tool and die makers needed to help develop the machines needed to build your next generation silicon and mother boards, and those ram chip thingies. To avoid all the tariffs from China they’re mining rare earth on mars and conveyor belted back on to America in the frunk of the swastitrucks.

It’s everything computer.

Believe in Trump, he believes in you. Or not.

Most likely not. He doesn’t care about you. He only cares about charging the government insane amounts to his golf course so he can golf while messing up his presidential diapers and getting rich off your tax dollars while wearing pants pulled up to his orange cheetos nip nips.

I cannot wait to see the stock markets reaction tomorrow.